The Career Pathways program identifies struggling high school students in Anderson County and matches them with office jobs at local nonprofit agencies. There, the students spend a semester learning practical job skills, discipline, and responsibility. Each student is also matched with a mentor who offers guidance, support, or simply a listening ear. For many students, the program provides direction they never had before. Here’s Sky’s story:

When Sky was accepted into Career Pathways she didn’t have much focus. Teachers and administrators were worried she wouldn’t graduate but more concerned she wouldn’t do anything after. Her interests were low and she didn’t have much of a vision for her life. She was placed working at the Children’s Museum and assigned a mentor who helped her along the way. What Sky found during her 16 weeks there was a love of teaching children – she now has a passion and a vision for her life and is planning to start classes this fall to become a teacher. The Children’s Museum loved her so much they hired her directly for the summer!

Interested in becoming a mentor or supporting a Career Pathways student? Email Naomi at naomi@uwayac.org today!

Periods. Tampons. Pads. Feminine hygiene wipes. All “dirty” words. Words that hold stigma, embarrassment, shame, and a cultural component. It’s something often not discussed but it’s time to talk about a need often being unmet.

It’s been referred to as “Period Poverty”. Girls and women going without feminine hygiene products. Specifically girls in school going without. Many girls would rather miss class than go to school menstruating if they lack access to these products. School counselors here in Anderson County have said that they have at least 2-3 students each month skipping multiple days due to lack of access to hygiene products.

This need has gone unmet for so long but no more. It is unacceptable for girls to go without their basic needs.

We put out the call for donations and this community delivered in a BIG way. THOUSANDS of tampons, pads, feminine hygiene wipes, bags, chocolate and underwear were donated.

We made and distributed over two thousand bags full of products for girls in middle and high school in Anderson County.

Over two thousand bags were assembled and delivered to 5 schools in Anderson County which served as pilot programs to finalize best practices. This fall we will roll this initiative out to every single middle and high school throughout the entire county. We are still accepting all the items above. If you would like to donate to the imitative please email kane@uwayac.org

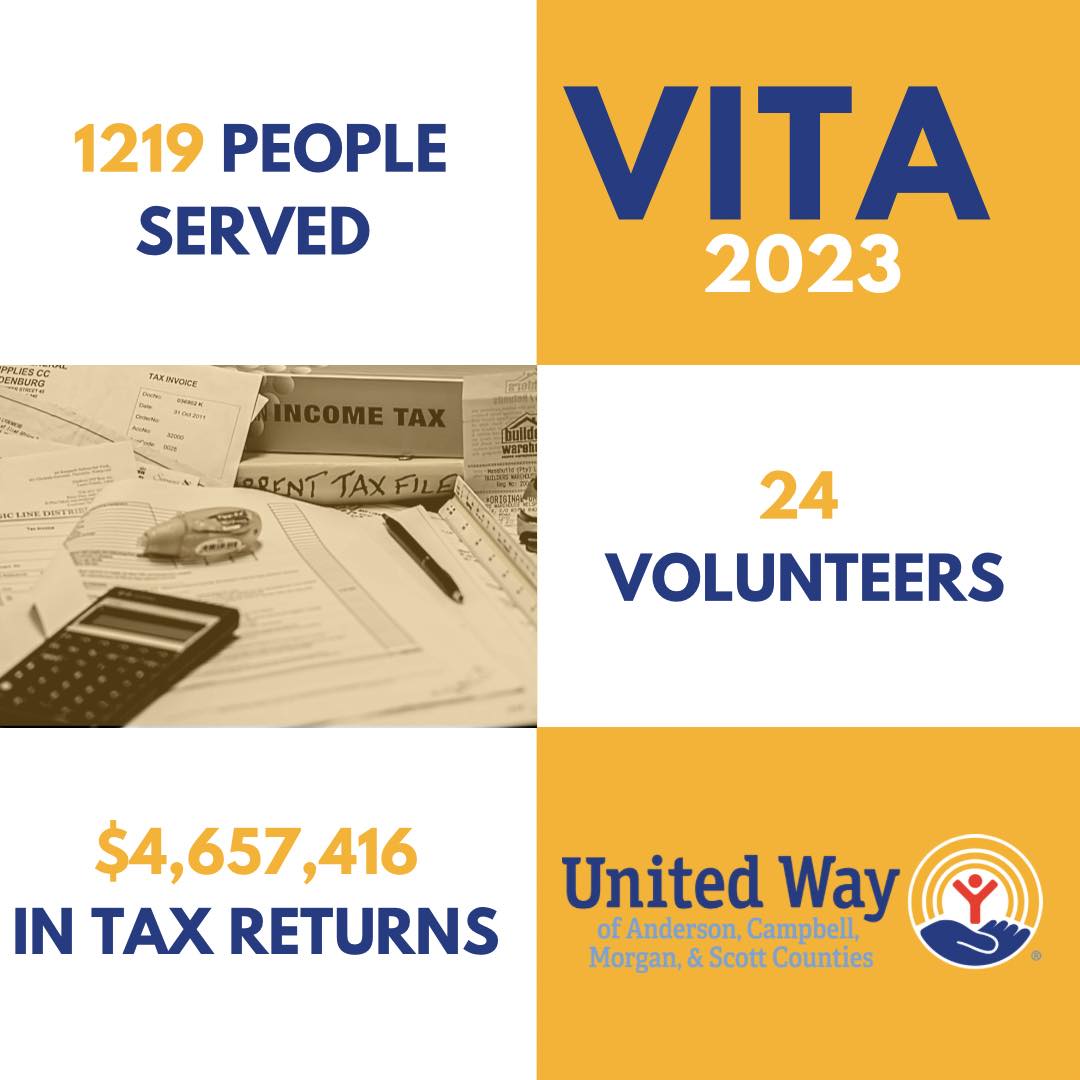

Anderson County partners with community volunteers to expand the availability of free tax preparation services in the area to households with an income of $53,000 or less. VITA (Volunteer Income Tax Assistance) is sponsored by the IRS and run by communities wishing to provide the service to their residents. VITA tax preparers can prepare returns with credits including: Additional Child Tax Credit, Child and Dependent Care, Education Credits, Retirement Saver’s Credit. VITA tax preparers cannot complete forms containing: Schedule C with losses, Complicated & advanced Schedule D (capital gains and losses), Form SS-5 (request for Social Security Number, Form 8606 (non-deductible IRA), Form 8615 (minor’s investment income), or Form SS-8 (determination of worker status for purposes of federal employment taxes and income tax withholding.

2023 Numbers

Total Tax Forms Filed: 1,219

Total Federal Refund: $4,657,416.00

New Procedures:

VITA TAX CENTER TO OPEN FEBRUARY 6, 2024

Hours are Tuesday-Friday 1pm-6pm, Saturday 10am-12:30pm

VITA (Volunteer Income Tax Assistance) is an IRS program sponsored in Oak Ridge by the Anderson County United Way and is operated entirely by a volunteer staff. The twenty-six volunteers have a total of 325 years of experience with the VITA Program and have prepared 1500-2000 returns a year since the 1980’s. The Oak Ridge program has served taxpayers from over a dozen East Tennessee counties.

For a complete listing of what VITA tax preparers can/cannot prepare and what you need to bring, visit www.irs.gov.

VITA 2024

Where: 301 Broadway Ave, Oak Ridge

When: February 6, 2024 – April 15, 2024

Hours:

Tuesday through Friday: 1:00-6:00

Saturday: 10:00-12:30

Walk-ins only, no appointments.

Please bring Photo ID, Social Security Cards, W-2s, 1099s, Social Security Statements, 1095-C, Health Insurance Information, 2021 Taxes

Locations:

Vita Oak Ridge:

United Way of Anderson County – 301 Broadway Ave., Oak Ridge